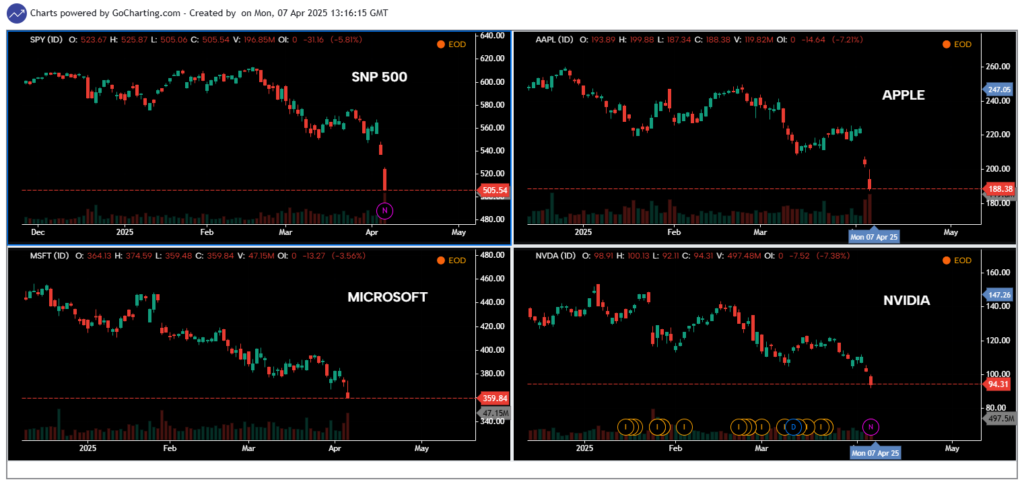

US Stocks Markets Lost 10 Trillion, Since Donald Trump began his second term in 2024, the U.S. stock market has seen a historic decline—shedding over $10 trillion in value. Investors, analysts, and everyday citizens are left wondering: what’s causing this financial bloodbath?

Regular updates, news, information and much more posted on daily basis on Espablo’s social media, make sure to follow Espablo on all platforms, and help us to grow.

Table of Contents

US Stocks Markets Lost 10 Trillion

In just over a year since Trump returned to the White House, the S&P 500, Nasdaq, and Dow Jones have all experienced significant downturns. While markets naturally fluctuate, a $10 trillion wipeout is far from ordinary. This isn’t just a correction—it’s a full-blown economic event.

What’s Fueling the Meltdown?

- Uncertainty in Leadership

Trump’s return came with bold policy shifts, abrupt staff changes, and combative rhetoric—both at home and abroad. Markets thrive on stability. But under Trump’s second term, uncertainty has become the new norm, shaking investor confidence. - Rising Interest Rates

The Federal Reserve, aiming to combat inflation, has continued raising interest rates. While not directly controlled by Trump, his administration’s spending and economic policies have contributed to inflationary pressures, forcing the Fed to act. Higher interest rates mean borrowing is more expensive—for both businesses and consumers. - Deregulation and Policy Reversals

Trump’s second term has reversed several Biden-era regulations, particularly in energy and environmental sectors. While some businesses welcomed these changes, the lack of long-term regulatory clarity has created confusion in industries that need stability to plan ahead. - Global Tensions and Tariffs

Trade tensions are escalating again. Trump has reintroduced aggressive tariffs on imports from China, the European Union, and even some allies. While meant to bolster American manufacturing, these tariffs have triggered retaliatory measures, increasing costs for U.S. companies and reducing export opportunities. Global supply chains are once again under pressure, making goods more expensive and hard to obtain. - Tech Sector Pullback

Big Tech, once the engine of market growth, has taken a hit. With new antitrust efforts, restrictions on data usage, and reduced consumer spending, tech giants have seen their valuations plummet—dragging major indexes down with them.

How Tariffs Are Hurting, Not Helping

Trump’s “America First” approach has once again leaned heavily on tariffs. While the goal is to protect American jobs and businesses, the reality is more complex. Tariffs increase the cost of imported goods, which in turn raises prices for consumers and manufacturing costs for U.S. companies relying on global supply chains. Countries hit by U.S. tariffs have responded with their own, harming American exports like agriculture and machinery. Economists argue that instead of boosting domestic growth, tariffs are stifling it.

Is Recovery Possible?

It’s not all doom and gloom. The U.S. economy remains resilient, and some sectors—like defense, energy, and healthcare—are performing well. But unless major policy adjustments are made, experts warn that market volatility could continue for the foreseeable future.

Final Thoughts

The $10 trillion market loss is a wake-up call. Trump’s second term has brought bold changes, but at a steep cost to investor confidence and market stability. Whether this is a temporary adjustment or a longer-term decline depends on how policies evolve moving forward. One thing’s for sure: the world is watching, and the stakes couldn’t be higher.

Hope, This detailed guide will answer How to Use DeFiLlama, Hope you will like it, For more updates on crypto airdrops, news, and insights, follow Espablo on social media and visit our website regularly. Stay connected to get the latest information and opportunities in the crypto world.