A complete guide about How To Monitor Whale Trades On Dextools Free, By following these trades you can increase your profits as well, Also you can predict market better with smart money moves.

Table of Contents

How To Monitor Whale Trades On Dextools Free

Do you ever noticed a token pump out of nowhere, only to realize later that a whale bought in 10 minutes before?

Let’s understand the concept of Whale trades, Whales are those who much have bigger capital than retail traders. They have access the data that is not available for retail traders, They have insider tips, Latest news and much more. Whales are always some steps forward than normal people. Why it is important to track whale activity and how it can be beneficial for us? Let’s understand, By tracking whale trades we can predict the next move of market, because they have secret resources that retails and small traders don’t have. We can close our position before the dump by only tracking the whale activity.

Why Monitoring Whale Trades Matters in Crypto

In the crypto world, “Whales” are wallets that holds large amounts of tokens usually worth tens of thousands, sometimes even millions of dollars. In the Crypto market, when a whale moves, it creates waves, those waves can be sudden price swings, massive volume spikes, or even complete trend reversals.

Whales trades can influence markets in powerful ways, For example, when a whale buys a huge amount of a small-cap token, it causes the price pumps quickly. Other traders notice the action and jump in, pushing the price even higher. On the flip side, if a whale sells off their holdings, it can trigger a domino effect where smaller holders panic and sell too, causing the price to crash.

Let’s say a whale drops $300,000 into a newly launched token on Ethereum. Within minutes, the price jumps by 40%. If you had been tracking that wallet, you might have spotted the trade early and acted before the crowd caught on.

This strategy is especially effective with low-cap tokens the kind you find on DEXs like Uniswap or PancakeSwap, because just a few big trades can move the price significantly. That’s why tools like Dextools are so useful they give you live access to these trades as they happen.

While technical indicators like RSI or MACD are useful, they show what’s already happened. Whale tracking, on the other hand, gives you a edge of what’s happening right now and sometimes even what might come next. By keeping an eye on the big players, you’re not just guessing, you’re observing real moves from wallets that often know something others don’t. And the best part? You can start doing it for free.

What Is Dextools and Why It’s Perfect for Whale Tracking

DEXTools is a free, real-time analytics platform that gives you a powerful view into what’s happening on decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and more. Whether you’re trading meme coins or serious DeFi tokens, Dextools lets you watch every trade as it happens no delays, no limits, no logins.

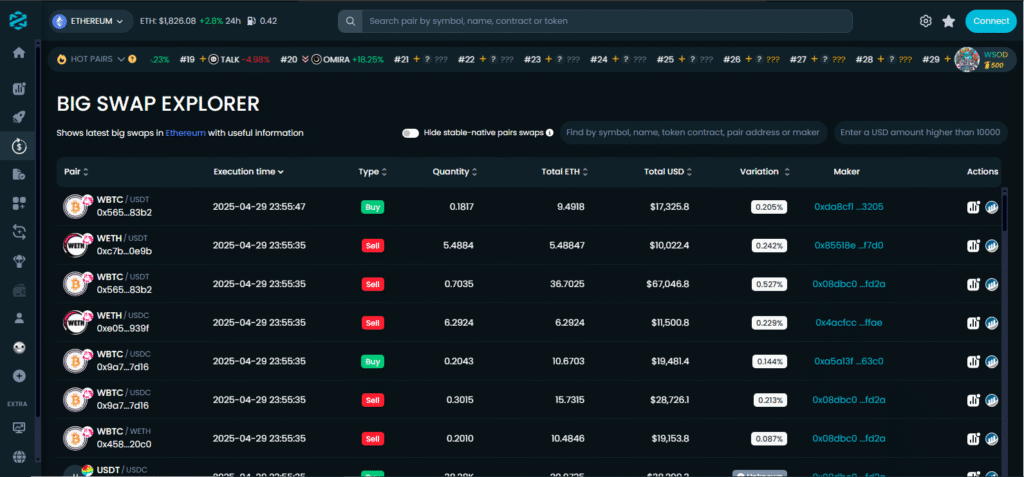

What makes DEXTools especially useful for tracking whale trades is how it breaks down complex blockchain data into easy-to-read dashboards. One of its best features is the “Big Swap Explorer” a tool that highlights large trades, so you can quickly spot when whales are buying or selling a token.

Here are some of the standout features that make DEXTools so effective:

- Live Trade Feed: Watch buys and sells appear in real time.

- Liquidity Info: See how much money is locked in the pool, and track liquidity changes.

- Big Swaps Filter: Automatically highlights high-value trades that could move the market.

- Wallet Clicks: Click any trade to see the wallet behind it, and analyze their activity.

Dextools, on the other hand, combines speed, simplicity, and depth, all for free. There’s no login required, and you don’t need to connect your wallet to use its core features. That means you can start tracking whale trades in seconds, with zero risk to your privacy or security.

If you’re serious about spotting smart money moves and reacting fast, DEXTools is the perfect starting point and it doesn’t cost a dime.

Step-by-Step: How to Monitor Whale Trades on Dextools Free

Ready to spot whales in action? DEXTools makes it super easy and the best part is, you don’t need an account, wallet connection, or subscription. Just follow these simple steps to start tracking big trades on any token.

Step 1: Visit DEXTools.io

Go to https://www.dextools.io in your browser. You’ll land on the homepage where you can access data from multiple blockchain networks like Ethereum, BNB Chain, Base, Arbitrum, and more.

Step 2: Choose the Network & Token Pair

On the left side of the screen, select the blockchain network you’re interested in (e.g., Ethereum or BNB Smart Chain).

Next, use the search bar at the top to type in the name or contract address of the token you want to track (e.g., $PEPE or $DOG).

Select the correct trading pair (like PEPE/ETH) from the list that appears.

Step 3: Open the Token’s Pair Explorer

Once you click the trading pair, you’ll be taken to the Pair Explorer page. Here you’ll find live charts, trade history, volume, liquidity, and other details about that specific token pair.

Step 4: Scroll to “Big Swap Explorer”

Scroll down the page until you find the Big Swap Explorer section.

This is where the magic happens you’ll see only the large trades (usually above a certain dollar or ETH value).

Each row shows:

- Time of the trade

- Wallet address that made the trade

- Token amount bought or sold

- USD/ETH value of the trade

Step 5: Click Wallet Addresses to Investigate

Curious about who made that $150K buy? Click on the wallet address next to the trade. DEXTools will open a mini-profile showing that wallet’s recent trades. Want to dig deeper? Click again to view the wallet on Etherscan, or copy the address to paste into Arkham, DeBank, or Zapper for more detailed wallet tracking.

Bonus Tip: Customize What Counts as a Whale Trade

The “Big Swap Explorer” auto-filters based on the token’s volume, but you can define your own limits using DEXTools PRO (paid).

If you want to stay free, just scan the trades manually and focus on ones that stand out like 10+ ETH buys or $50,000+ moves.

How to Analyze Whale Behavior and Make Smart Moves

Tracking whale behavior isn’t just about spotting big trades, it’s about recognizing patterns and using that info to make smart moves. When analyzing DEXTools’ Big Swap data, pay attention to trade size, timing, and repeat wallet addresses. These clues help you figure out whether a whale is quietly accumulating or preparing to dump. For example, if a wallet is buying in multiple chunks, they might be trying not to move the market too fast, a bullish sign. If big buys come during or just before news breaks, it could signal insider knowledge. Once you spot a whale trade, here’s how to react wisely:

- Front-run potential price moves by entering early on whale buys (especially in low-cap tokens).

- Avoid becoming exit liquidity by staying cautious after large sells.

- Use tools like Etherscan and Arkham to research the wallet’s past activity and token history.

By combining DEXTools with deeper research, you can follow smart money with confidence, not emotion.

Common Mistakes to Avoid When Tracking Whales

While tracking whales can give you a serious edge, it’s easy to fall into traps if you’re not careful. Many new traders mistake random large trades for “smart money” but not every big buyer is experienced or even making the right move. Some wallets just ape in with no research, and following them blindly can lead to losses. It’s also risky to chase trades without checking fundamentals like token utility, community support, or developer activity.

Before acting on any whale trade, always verify the contract address, tokenomics, and whether the project is legit. And remember don’t let a single wallet’s move control your entire strategy. Acting emotionally or overtrading can be worse than missing out. Use whale tracking as a tool, not a signal to go all in.

Here are some common mistakes to avoid:

- Assuming every big trade is smart money

- Focusing only on wallets and ignoring fundamentals

- Skipping due diligence on token safety and contracts

- Making trades just because one wallet did

Final tip: Use whale tracking alongside technical analysis, market trends, and solid research that’s how real winners trade smart.

Conclusion

Whale tracking on DEXTools is a smart way to stay one step ahead in the fast-moving crypto market. By watching large trades and understanding wallet behavior, you can spot opportunities before the crowd. Just remember it’s a helpful tool, not a guaranteed signal. Combine it with research and smart risk management for the best results.

Hope, This detailed guide will answer, How To Monitor Whale Trades On Dextools Free, Hope you will like it, For more updates on crypto airdrops, news, and insights, follow Espablo on social media and visit our website regularly. Stay connected to get the latest information and opportunities in the crypto world.